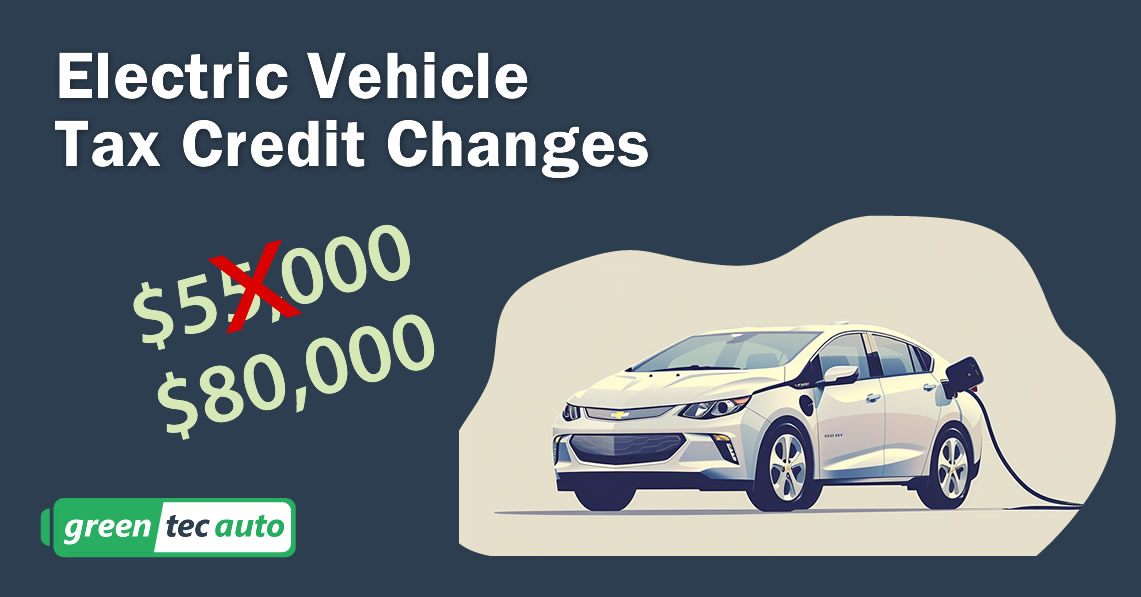

The U.S. Treasury Department recently revised its classification of certain electric vehicles (EVs), significantly impacting EV tax credit eligibility. These updates allow some vehicles, previously categorized as cars, to qualify as SUVs, increasing their eligibility for EV federal tax incentives. SUVs can now qualify for up to $7,500 in electric vehicle tax credits with a manufacturer-suggested retail price (MSRP) limit raised to $80,000, compared to $55,000 for cars.

Why Did the Treasury Update EV Tax Credit Eligibility?

The change comes after automakers and consumers raised concerns about inconsistencies in vehicle classifications. Previously, the Treasury used the EPA’s Corporate Average Fuel Economy (CAFE) standard to determine vehicle types for EV federal tax incentives. However, this method caused confusion.

To address this, the Treasury switched to the consumer-facing EPA Fuel Economy Labeling standard, ensuring vehicles with similar features are classified consistently. This adjustment is critical for streamlining EV tax credit eligibility for crossovers and SUVs.

Key Changes to EV Federal Tax Incentives

What Was the Problem?

When the Inflation Reduction Act expanded electric vehicle tax credits, the IRS’s initial classifications led to discrepancies. For example:

- Some Tesla Model Y variants qualified for EV tax credits, while others didn’t.

- Volkswagen ID.4’s rear-wheel-drive version was labeled a car, while the all-wheel-drive model was classified as an SUV.

Why the Update Matters

The distinction between cars and SUVs is significant. Cars qualify for EV federal tax incentives if their MSRP is under $55,000, while SUVs and larger vehicles qualify if their MSRP is below $80,000.

Which Vehicles Now Qualify for Electric Vehicle Tax Credits?

Under the updated rules, these vehicles are eligible for EV federal tax incentives with an MSRP cap of $80,000:

- Ford Mustang Mach-E

- Cadillac Lyriq

- Lincoln Corsair Grand Touring

- Tesla Model Y (5-seat variants)

- Volkswagen ID.4 (all models)

Consumers who purchased an EV on or after January 1, 2023, can claim electric vehicle tax credits under these new standards, even if their vehicle didn’t qualify previously.

Remaining Challenges: EV Tax Credit Eligibility for Batteries

Although the Treasury clarified vehicle classifications, questions remain regarding EV tax credit eligibility based on battery mineral origins. Starting in March, eligibility will depend on where the minerals used in EV batteries are sourced. Further guidance from the Treasury is expected soon.

How to Ensure Your Vehicle Qualifies for EV Tax Credits

To claim EV federal tax incentives, buyers should:

- Verify their vehicle’s classification (car or SUV).

- Check the MSRP against the eligibility thresholds.

- Ensure the final assembly occurred in North America.

Conclusion

The updated classification system for electric vehicle tax credits offers clarity and expanded options for consumers. By addressing inconsistencies, the Treasury has made it easier for buyers to determine their EV tax credit eligibility.

For more details on qualifying vehicles, refer to the official IRS list of eligible models.

| MY | Vehicle | MSRP |

| 2023 | Audi Q5 TFSI e Quattro (PHEV) | $80,000 |

| 2021, 2022, 2023 | BMW 330e | $55,000 |

| 2021, 2022, 2023 | BMW X5 xDrive45e | $80,000 |

| 2022, 2023 | Cadillac Lyriq | $80,000 |

| 2022, 2023 | Chevrolet Bolt | $55,000 |

| 2022, 2023 | Chevrolet Bolt EUV | $55,000 |

| 2022, 2023 | Chrysler Pacifica PHEV | $80,000 |

| 2022, 2023 | Ford E-Transit | $80,000 |

| 2022, 2023 | Ford Escape Plug-In Hybrid | $80,000 |

| 2022, 2023 | Ford F-150 Lightning | $80,000 |

| 2022, 2023 | Ford Mustang Mach-E | $80,000 |

| 2022, 2023 | Jeep Grand Cherokee 4xe | $80,000 |

| 2022, 2023 | Jeep Wrangler 4xe | $80,000 |

| 2022, 2023 | Lincoln Aviator Grand Touring | $80,000 |

| 2022, 2023 | Lincoln Corsair Grand Touring | $80,000 |

| 2021, 2022, 2023 | Nissan Leaf S | $55,000 |

| 2021, 2022 | Nissan Leaf S Plus | $55,000 |

| 2021, 2022 | NIssan Leaf SL Plus | $55,000 |

| 2021, 2022 | Nissan Leaf SV | $55,000 |

| 2021, 2022, 2023 | Nissan Leaf SV Plus | $55,000 |

| 2022, 2023 | Rivian R1S | $80,000 |

| 2022, 2023 | Rivian R1T | $80,000 |

| 2022, 2023 | Tesla Model 3 Long Range | $55,000 |

| 2022, 2023 | Tesla Model 3 Performance | $55,000 |

| 2022, 2023 | Tesla Model 3 RWD | $55,000 |

| 2022, 2023 | Tesla Model Y SWD | $80,000 |

| 2022, 2023 | Tesla Model Y Long Range | $80,000 |

| 2022, 2023 | Tesla Model Y Performance | $80,000 |

| 2023 | Volkswagen ID.4 | $80,000 |

| 2023 | Volkswagen ID.4 AWD Pro | $80,000 |

| 2023 | Volkswagen ID.4 AWD Pro S | $80,000 |

| 2023 | Volkswagen ID.4 Pro | $80,000 |

| 2023 | Volkswagen ID.4 Pro S | $80,000 |

| 2023 | Volkswagen ID.4 S | $80,000 |

| 2022 | Volvo S60 (PHEV) | $55,000 |

| 2022 | Volvo S60 Ext. Range | $55,000 |

| 2023 | Volvo S60 T8 R (Ext. Range) | $55,000 |

Electric Vehicle (EV) Tax Credit FAQ

1. Have recent changes been made to EV tax credit eligibility?

Yes. The U.S. Treasury Department reclassified certain EVs as SUVs, increasing their eligible MSRP limit for tax credits from $55,000 to $80,000.

2. Were the classification updates made to address inconsistencies?

Yes. The updates were made after automakers and consumers highlighted inconsistencies in vehicle classifications under the previous standards.

3. Does the MSRP impact whether an EV qualifies for tax credits?

Yes. Cars qualify if their MSRP is below $55,000, while SUVs and larger vehicles qualify if their MSRP is under $80,000. Taxes, dealer fees, and delivery charges are not included in this limit.

4. Are some Tesla and Volkswagen models now eligible for tax credits?

Yes. Tesla Model Y (5-seat versions) and all Volkswagen ID.4 models are now eligible under the new classification rules.

5. Does the EPA standard now determine vehicle classification for tax credits?

Yes. The EPA Fuel Economy Labeling standard replaced the previous CAFE standard, resolving issues with inconsistent classifications.

6. Can consumers who bought EVs earlier in 2023 still claim tax credits?

Yes. Consumers who purchased EVs on or after January 1, 2023, can claim credits under the updated rules, regardless of previous eligibility.

7. Do the new rules apply to all EVs?

No. While the rules clarify classification, some vehicles may still be ineligible based on battery mineral origin, with further guidance expected in March.

8. Will battery mineral origins affect EV tax credit eligibility?

Yes. Starting in March, eligibility will also depend on where the minerals used in the vehicle’s battery are sourced.

9. Is the updated classification system beneficial for consumers?

Yes. The changes allow more EVs to qualify for tax credits, giving consumers more options when choosing an eligible vehicle.

10. Should buyers check vehicle classifications before purchasing?

Yes. Buyers should verify their vehicle’s classification, MSRP, and assembly location to ensure it qualifies for federal EV tax credits.

Important Pricing Disclaimer:

Please note that the pricing and other details for batteries mentioned in this blog post were accurate at the time of its original publication. However, due to factors such as market conditions, raw material costs, and inventory, prices are subject to change without notice.

For the most up-to-date pricing and availability, we encourage you to visit our website’s product pages or contact our sales team directly when placing your order. The prices listed at the time of your order will be the applicable charges. We appreciate your understanding.